Renewables: Untapped solar potential

Adamou Fofana, Accra, Ghana

March 10, 2023

Alow-carbon power generation requires a diversified source of energy. Although Ghana has abundant sunshine, the country derives less than one percent of its electricity from solar. The country has identified solar as a potential major contributor to the country's electricity mix, which can alleviate the challenges of hydropower for example. Drought causes fluctuation of water levels, making hydropower unreliable. Solar has the potential to contribute to the diversification of energy sources and reduce carbon emissions. In 2022, data from the Ghana Energy Commission showed that the major sources of energy were 65.3 percent from thermal, 34.1 percent from hydro and 0.55 percent from renewables. Solar energy accounted for less than 1 percent of the total energy supply. Despite the capital high capitgal expenditure, the major advantage of solar is its modularity. Clusters of solar mini-grids and inject excess production into the national grid.

Solar potential

The solar irradiation in Ghana ranges from 5 to 6 kWh/m² per day1. In the city of Wa, the capital of the Upper West region, experts recorded the country's highest level of solar irradiation (5.524 KWh/m2-day) in 2002. The month of May has the highest solar irradiation (5.897 KWh/m2-day), with August recording the lowest measurement (4.937kWh/m2-day). Akim Oda, on the contrary, is the location that records the lowest radiation (4.567kWh/m2-day) measurements across the country2. Still, these estimates show that sunlight will provide useful solar energy for at least four to six hours per day3.

Despite economic reforms and rising demand, solar energy struggles to attract financing. The average cost of electricity generation, from solar PV decreased by 82 percent between 2010 and 2019, according to The International Renewable Energy Agency (IRENA). IRENA explains that new technology solutions make solar energy the least-cost option for new electricity generation. In other words, the cost of solar project is falling but banks and investors are still reluctant.

Lanscape

The Energy Commission takes a holistic view of the solar sub-sector in which it seeks to promote off-grid and on-grid solutions and also develop adequate financing mechanims for solar. The Commission is the key lynchpin between different stakeholders which include the public and private institutions and also bilateral and multilateral partners.

The goal of the commission is to address structural market issues that are blocking the development of solar energy. One of the main reasons behind low investment in solar is a lack of technical capacity for the development solid bankable renewable energy (solar) projects. Domestic banks are also reluctant to fund energy projects and cite high risks as the main obstacles.

Solar companies and stakeholders in Ghana

In the medium term, the Commission enable a solar value chain, which will include the manufacturing in Ghana of panels, inverters, lamps, transmission cables and other solar energy accessories. Another area of priority for the Commission is the acquisition and development of Solar storage technology. Ghana depends on import for all forms of renewable energy storage systems. This dependence carries a cost premium that depress electricity prices and potentially deterring investors.

On the other hand, civil society organisations are calling for more disclosure of information regading Power Purchase Agreements (PPA). The Ghana Institute of Economic Affairs (IEA) and the global think tank Energy for Growth Hub (EFGH - Washington DC) have called for more transparent approach for contracting power in the future. In a joint research paper, they indicate that ‟non-disclosure of PPAs has also significantly contributed to poor sector planning and coordination” which is leading to mounting public debt. The government began to heed these calls in 2020, when it conducted a detailed legal and financial analysis and Electricity Sector Reform Programme (ESRP). The analysis looked at 15 existing and near-operational power projects. Since the review, the goverment has decreed a moratorium ‟ on signing new PPAs, Gas Supply Agreements, Put-Call Option Agreements and long-term take-or-pay contracts”. The government is now requiring that all future PPAs be conducted through open and transparent competitive procurement processes4.

Renewable Energy Master plan

In its 2019 Ghana Renewable Energy Master Plan (REMP), the government outlines initiatives to boost the development of solar projects. The REMP highlights strategies to promote utility scale solar projects through financing, such as bonds, shares, loans. The government commits to implementing competitive tariff and also to the modernization of transmission. This will make it possible for independent producers to inject excess production into the national grid. Other measures include making land available as equity in projects and the signing of power purchase agreements (PPAs). The PPA will depend on the financial viability of the project.

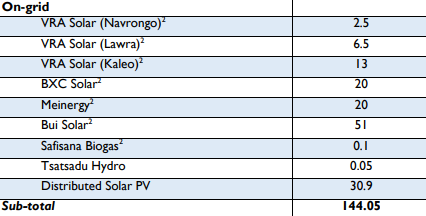

Ghana operates nine solar plants, which produce about 144.05 megawatts in 2022. These plants connect to the national grid.

Active solar power plants

Unmet demand

Ghana’s solar market has attractive segments, according to a report from the International Finance Corporation (IFC)5. These segments include commercial and industrial customers and also residential customers. Commercial and industrial customers represent 57 percent of the market and residential 43 percent. By 2025, these two market segments will likely grow at rates of 34 percent (commercial and industrial) and 47 percent (residential). This translates in US$102 million for residential and US$47 million for commercial and industrial. An incremental increase in tariffs is the driving growth factor. In 2021, tariffs increased 11.17 percent from the 2018 rates. In 2022, the Public Utilities Regulatory Commission (PURC) increased the average end-user tariff by 27.15 percent (for electricity) and by 21.55 percent (water)6.

Across the major market segments, barriers persist. For example, low awareness and perceived cost of solar solutions continue to hinder adoption. However, in 2022, solar energy received a boost from the World Bank, after the launch of the Scaling-up Renewable Energy Program in Ghana Investment Plan (SREP). The government of Ghana worked with the World Bank, the AfDB, and other stakeholders to develop SREP. One of the major objectives of this program is the acceleration of electrification through renewable energy. The value of the SREP grant is $69.88 million 2022 and 2025.

Spotlight: SUNREF

SUNREF (Sustainable Use of Natural Resources and Energy Finance) is a brainchild of the Agence Française de Développement (AFD)7. SUNREF mobilizes banks and investors in recipient countries around renewable energy. At the country level, for example in Ghana and in cooperation with the European Union, AFD provides a credit line combined with a grant to local partner banks. The European Union (EU) provides financing for the technical component and grants to eligible projects.

In Ghana, SUNREF invested EUR 30 million over three years (2020-2023). Canadian firm Econoler, was the technical adviser to the Ghana project implementation unit (PIU). The Ghana Energy Commission hosted the PIU, while Econoler helped the Ghana Energy Commission in the management and supervision of the SUNREF program. Two local banks, namely CAL Bank Ghana Limited (Calbank) and Ghana Commercial Bank (GCB Bank), offered access to financing for solar projects to businesses, institutions, and households.

At the international level, since its inception SUNREF has funded 50 projects in 30 countries. It has partnered with 80 banks and granted EURO 3 billion loans.

Related Articles

BIBLIOGRAPHY

1❩ Ministry of Energy and Energy Commission (February 2019): Ghana renewable master plan

2❩ https://energycom.gov.gh/files/Solar%20Data%20-%20final(1).pdf

3❩ https://www.nocheski.com/2016/09/30/what-is-ghanas-solar-power-potential/ see also the SWERA Ghana Project report (https://openei.org/datasets/files/710/pub/ghana_10km_solar_country_report.pdf)

4❩ Ishmael Ackah, Katie Auth, John Kwakye, Todd Moss (): A Case Study of Ghana’s Power Purchase Agreements - https://energyforgrowth.org/wp-content/uploads/2021/03/A-Case-Study-of-Ghanas-Power-Purchase-Agreements.pdf

5❩ IFC (2021): Ghana Distributed Solar Market Assessment - https://www.ifc.org/en/insights-reports/2021/ghana-distributed-solar-market-assessment

6❩ https://www.purc.com.gh/attachment/459725-20220816110856.pdf

7❩ https://www.afd.fr/fr/sunref-un-label-finance-verte-du-groupe-afd