Advertise Here

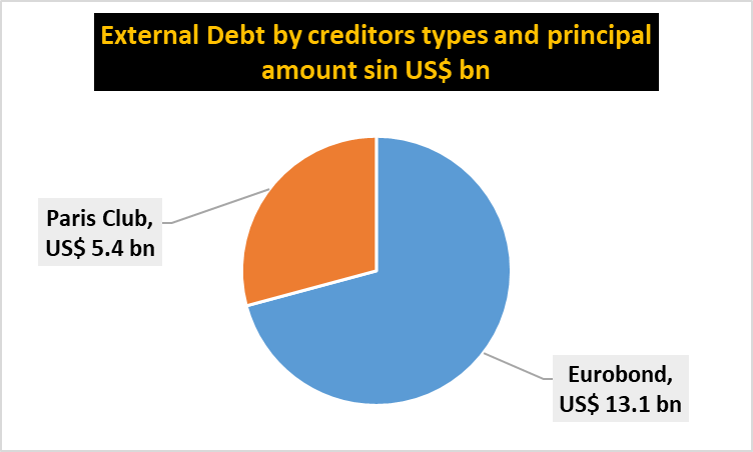

At the end of Q3-2024, the stock of central government external debt totaled US$31.97 billion (GH₵506.33 billion), which made up 62.7 percent of the total public debt stock and 49.63 percent of GDP. On June 2024, Ghana reached an agreement in principle (AIP) on the restructuring terms with 40 percent of Eurobond holders and also with the Regional Steering Committee, which represents 15 percent of the outstanding bond holders. In January 2025, Ghana also announced a agreement with 25 bilateral official creditors of the Paris Club to restructure $5.4 billion of debt.

Source: IMF, 2024

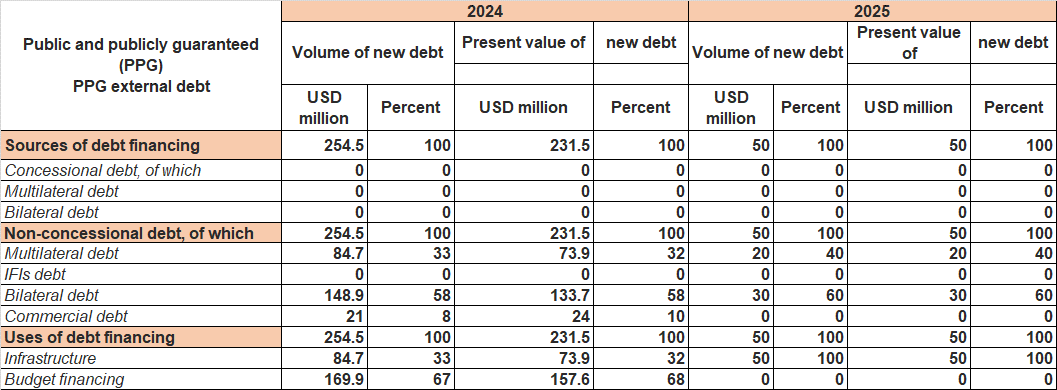

The Government did not pursue issuances on the International Capital Market (ICM) in 2023 because of global inflationary pressures, risks to emerging markets, and the decision to suspension debt servicing in December 2022.

The markets responded with sovereign rating downgrades. But the country is recording signs of recovery. In May 2025, S&P Global Ratings upgraded Ghana's credit rating from "Selective Default" (SD) to "CCC+".

Source: IMF, 2024

Source: Ministry of Finance, 2024

Source: Ministry of Finance, 2024

Source: Ministry of Finance, 2024

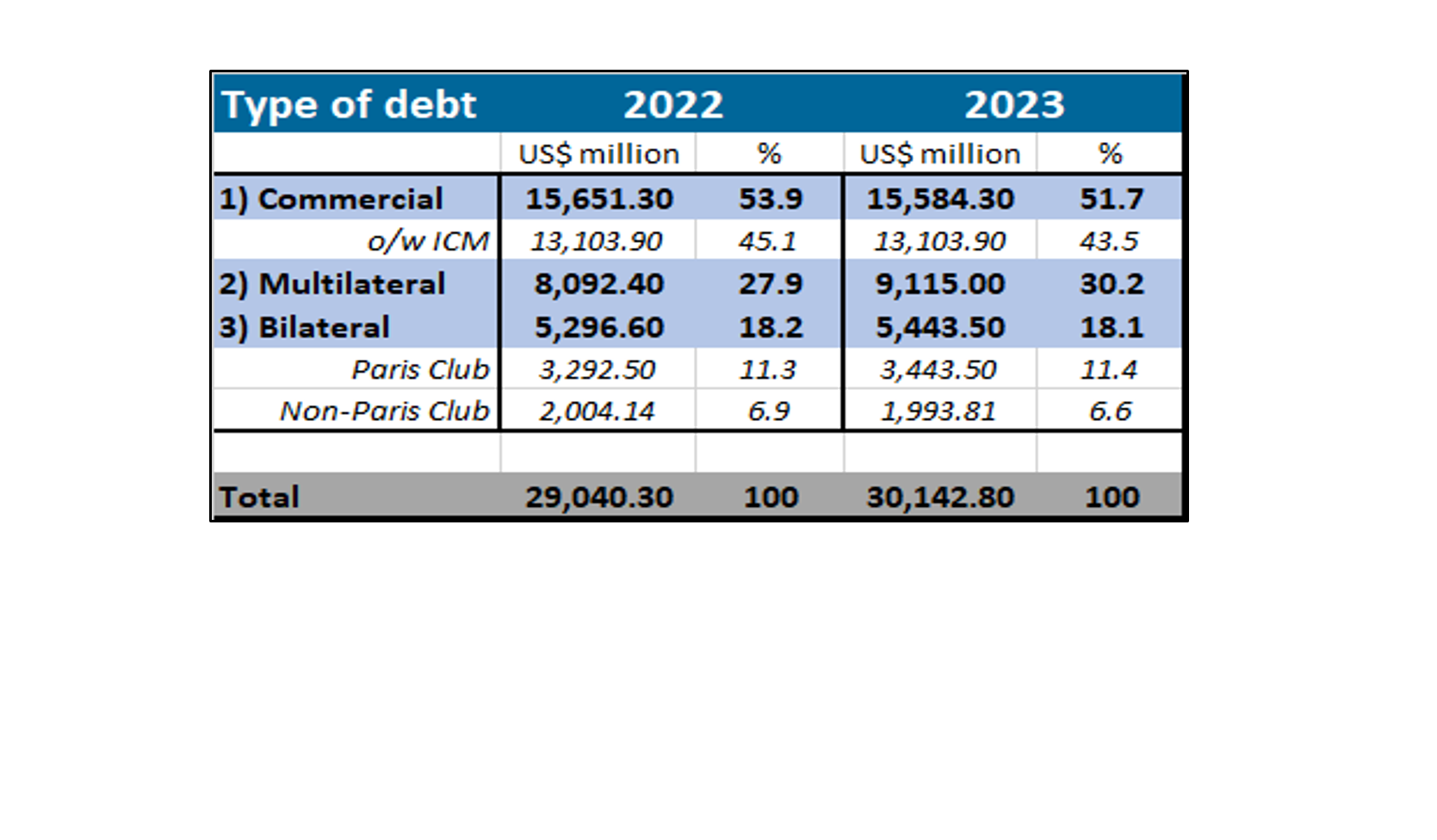

At end-December 2023, Eurobonds made up 43.5 percent of the external debt portfolio and 84.1 percent of the stock of commercial debt. During the same period, the share of multilateral debt increased to 30.2 percent from 27.9 percent at end-December 2022. This was because the main external source of financing for 2023 was from multilateral creditors. The share of bilateral debt decreased marginally to 18.1 percent in 2023 from 18.2 percent in 2022.

Source: Ministry of Finance, 2023