The rise of domestic remittances

Liz-Mary Abena, Kumasi, Ghana

February 27, 2024

G hana is the second largest recipient in West Africa. Over the past decade, remittances have become a major contributor to household income. The World Bank defines personal remittances as transfers in cash or in kind made or received by resident households to or from nonresident households. Compensation of employees on the other hand, refers to the income of border, seasonal, and other short-term workers who are employed in an economy where they are not resident and of residents employed by nonresident entities1.

Domestic Remittance on the other hand, refers to the transfer of money within the borders of a single country, typically from urban to rural areas. Experience from other countries for example India, show that domestic remittance is ‟a lifeline for many families, allowing members who've migrated to cities for work to send money back home” according to money transfer FinTech, Vance2.

Tracking domestic remittances

The rise of domestic remittances has forced policy makers to develop initiatives to boost growth in this area. In fact, domestic remittances are becoming an important tool in the fight against rural poverty. For policy makers, understanding the channels of transmission of domestic remittances is becoming crucial.

Data from the Ghana Statistical Service (Ghana Living Standards Survey) show insights into remittances by residence type. The survey shows that more than half 33 percent of those who received domestic remittances reside in the rural areas while 67.0 percent of Ghanaians receive foreign remittances reside in the urban areas 3.

Studies from the World Bank 4 indicate that the percentage of households receiving domestic remittances is on average higher than the percentage receiving international remittances. The Bank notes that ‟the poorest households do not benefit directly from international remittances, as much as they do from domestic remittances”. Another complexity is the changing demographics, according to the IOM (International Organization of Migration). The number of people who move within Ghana is higher than those who move out of the continent. The IOM sees this demographic pattern as a factor that will lead to the growth of remittances in the near future.

Shift from informal to formal

Ghanaian authorities want to capitalize on the momentum, for example by developing incentives the for adoption of electronic payments.

Before the introduction of these incentives, informality reign supreme with internal migrants often carrying money and goods with them, to remit when they go back to visit their villages. In a study of 16 developing countries, the International Monetary Fund (IMF)1, noted a shift from informal to formal domestic remittance channels during the pandemic.

Evidence of this shift also emerged in Ghana with a surge in e-payments. According to the GhIPSS (Ghana Interbank Payment and Settlement Systems Limited), COVID-19 accelerated the adoption of digital payments. At the end of 2020, instant payment transactions increased by 257 percent from 1.9 million in 2019 to 6.8 million. The availability of digital platforms during the lockdown, partly explains this switch from informal to formal. The adoption of digital payments also received a boost for tax exemptions on transactions and from reductions of mobile money fees2.

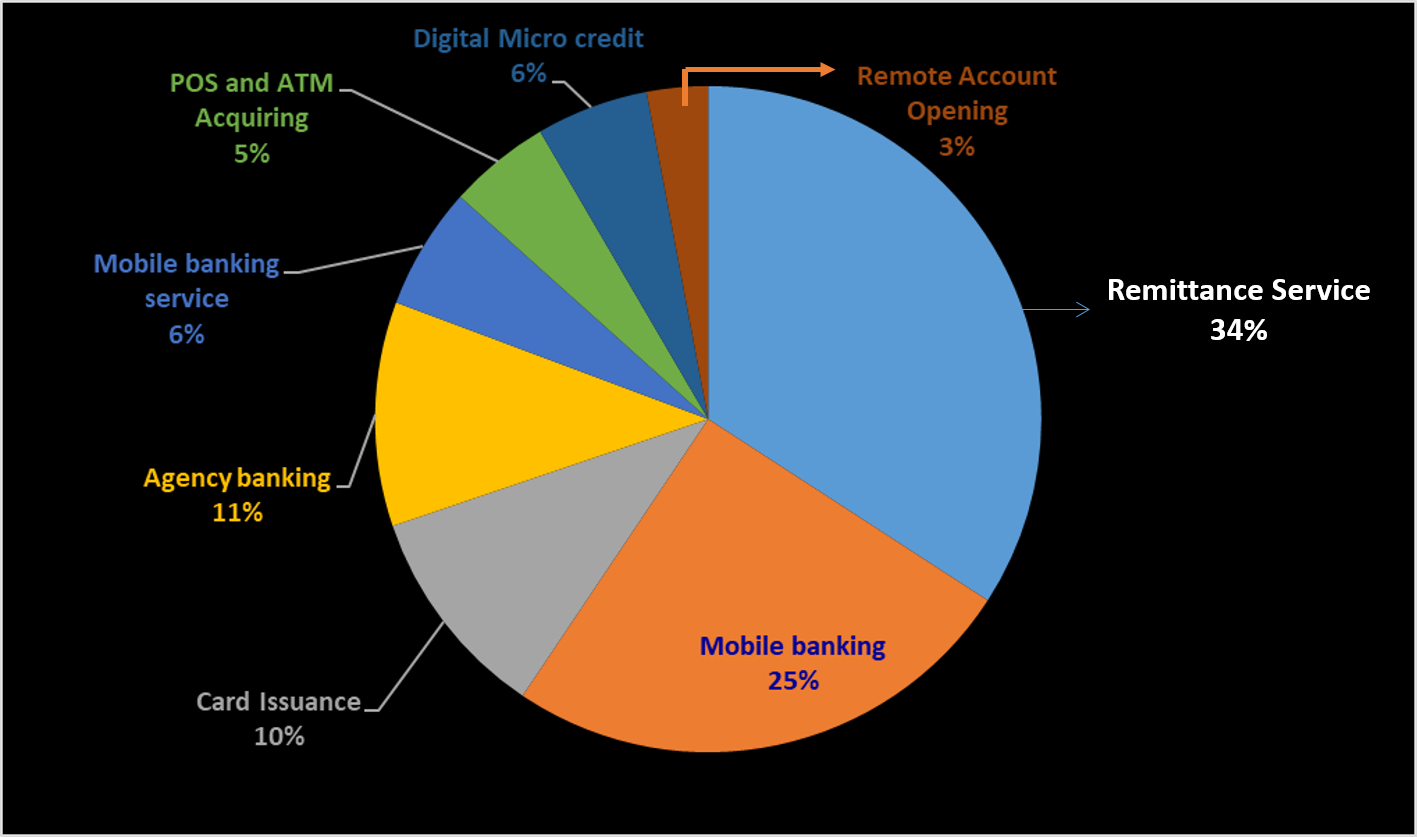

Remittances dominate domestic financial services

The Bank of Ghana approved A total of twenty-seven (27) products in 2023 compared to twenty-one (21) products and services approved in 20223. Remittances services represented 34 percent of the total products and services approved in 2023. In the approval report, the BoG highlighted the rise of registered mobile banking customers increased by 51.54 percent. The government sees mobile banking as a driver of growth for internal remittance and financial inclusion.

Major authorized products (2016-2023)

Source: Bank of Ghana, 2023

Since 2016, the BoG has also authorized six remote account opening systems, two WhatsApp Banking and two Virtual card services. The Central bank has also added two ATM deployment, three Chat Banking services and one Cheques clearing service. Today, Ghanaians have a palette of 224 active financial products on the markets.

These products and services are however concentrated in large urban cities and the Southern Coastal region of the country. Regulators hope that the penetration and expansion of new and scalable services from FinTech companies will sustain the growth of domestic remittances in rural areas.

Risk perceptions

Cash is a predominant feature of the rural economy in Ghana. Despite the increased adoption of digital payment methods, a perception of risk stemming from the rise in cybercrime persists. Cybercrime has the potential to increase liquidity risk and credit risk. In a 2022 report, the Bank of Ghana explained that the year 2021 recorded a minimal decline of 12.09 percent in the number of attempted fraud cases. The Bank reported 2,347 case (2,670 in 2020). However, the BoG also noted that the value of losses increased to US$5.1 million (GH¢61million) compared to US$2.1 million (GH¢25 million) in 2020. This represented a 144.00 percent increase in year-on-year terms. In a response, the Bank recommended an increase of the minimum capital requirements. It also introduced additional governance measures for payment service providers.

The country decided to improve security in the sub-sector through the Payment Systems and Services Act, 2019 (Act 987). One of the main goals of this Act is the introduction of ‟an appropriate security policies and measures intended to safeguard the integrity, authenticity and confidentiality of data and operating processes” .

Related Articles

BIBLIOGRAPHY

1❩ World Bank (2023): Personal remittances - https://data.worldbank.org/indicator/BX.TRF.PWKR.CD.DT?end=2023&start=2023&view=bar

2❩ Aayush Jain (2024): Domestic remittance - https://www.vance.tech/blog/domestic-remittance#:~:text=Domestic%20Remittance%20refers%20to%20the,to%20send%20money%20back%20home.

3❩ Ghana Statistical Service (2019): The Ghana Living Standards Survey (GLSS7) - https://www.statsghana.gov.gh/gssmain/fileUpload/pressrelease/GLSS7%20MAIN%20REPORT_FINAL.pdf

4❩ Samik Adhikari (2020): COVID-19 is reducing domestic remittances in Africa: What does it mean for poor households? - https://blogs.worldbank.org/africacan/covid-19-reducing-domestic-remittancess-africa-what-does-it-mean-poor-households

1❩ Kangni Kpodar et al. (2021): Defying the Odds: Remittances During the COVID-19 Pandemic, International Monetary Fund (IMF), https://www.elibrary.imf.org/view/journals/001/2021/186/article-A001-en.xml

2❩ GhIPSS (2021): GhIPSS Annual Media Engagement. The Ghana Interbank Payment and Settlement Systems Limited (GhIPSS) is a wholly owned subsidiary of the Bank of Ghana. https://www.ghipss.net/index.php/publications

3❩ Bank of Ghana (2020): Payments systems oversight – Annual report 2020. https://www.bog.gov.gh/wp-content/uploads/2022/02/Payment-Systems-Annual-Report-2020.pdf

5❩ https://www.bog.gov.gh/wp-content/uploads/2020/06/Banking-Sector-Developments-May-2020.pdf

6❩ https://mofep.gov.gh/press-release/2022-12-04/ghana-domestic-debt-exchange-ken-ofori-atta