Exploring Ghana's Fintech ecosystem

Desmond McKintyre, Dublin

August 10, 2024

Ghana wants to achieve a universal access to financial services. Over the past decade, the government has implemented various programs to foster financial literacy and broaden inclusion. In 2015, 58 percent of Ghana’s adult population had access to financial services. Access rose to 68 percent in 2021. This means that about a third of the Ghanaians adult population continues to have limited or no access to financial services. Rural residents and women are the underserved groups in the poorest regions (Upper West, Northern, Volta, Upper East, and Brong Ahafo). One important component in the government tool kit is the financial technology (FinTech).

FinTech is the application, adaptation, and delivery of financial services through digital technology. The expansion of these technologies has spurred the development of new business models, applications, processes, and products. These emerging companies provide corporate and retail services and products. In the retail markets, they offer savings, loans, deposits, insurance, and payments. Other services include digital currencies, cross-border payments, peer-to-peer loans, and credit risk assessments.

Landscape

The FinTech ecosystem of Ghana is an eclectic group of public and private institutions and firms. Government institutions develop laws and regulations, which include licensing and rules that protect customers. The central bank grants licenses and access to payments systems and network.

Under the purview of the Bank of Ghana, banks offer products and services or team up with FinTech companies. Public and private financial institutions need mobile phone networks to deploy and sell their products and services (e.g. funds transfers). Like banks, mobile phone, and internet network operators have also become providers of digital financial services and products.

The total number of licensed financial technology companies at the end of December 2022 was forty-six. This includes four electronic money issuers (DEMIs) and thirty-four payment service providers (PSP).

Bank of Ghana: Fintech vision

The BoG views FinTech firms as important enablers of financial inclusion and a means of improving the economic well-being of the Ghanaian. The bank has updated the legislation and set up a FinTech and innovation department.

In 2022, the BoG launched a pilot study for a digital currency called the e-Cedi, which it said is a prelude to digital wallets or a contactless smart card. The bank also developed a regulator sandbox, which fosters FinTech innovations by providing what the BoG calls a “congenial regulatory environment for financial sector regulators and innovators to collaborate”.

Through the sandbox, the BoG promotes products and services leveraging blockchain technology, SuPtech (supervisory technology) and e-KYC (electronic know your customer) platforms. The BoG encourages products and services targeting women and innovative payment solutions for micro, small, and medium-size enterprises (MSMEs).

Products and services

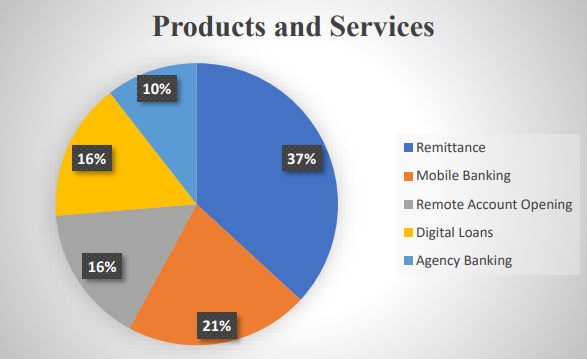

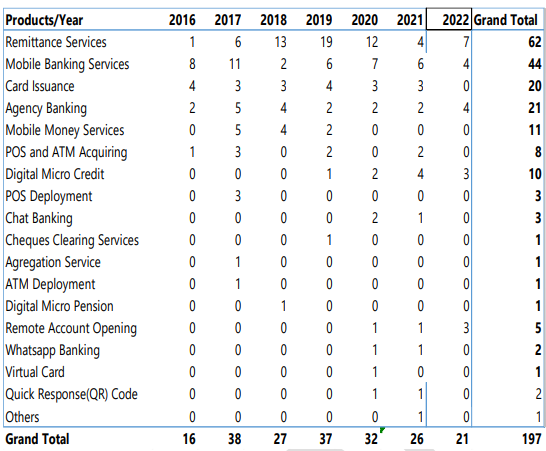

FinTech companies concentrate their activities on payments, cash management, micro loans, and domestic remittances. In 2022, the Bank approved twenty-one products and services (compared to 2021 (26), 2020 (32) and 2019 (37)). The products and services offered in-bound remittance, mobile banking services, remote account opening, and digital loans. Other products include agency banking, point-of-sales (POS) and ATM services, remote account opening, WhatsApp/chat banking and Quick Response (QR) code.

Source: Approved products and services, Bank of Ghana, 2022

The Bank approved mobile banking services for four financial institutions in 2022 (compared to six in 2021). Since 2016, the BoG has approved 197 products and services for various for various financial institutions.

Source: Bank of Ghana, 2022

Mobile money is boosting the growth of FinTech products and services. According to the Bank of Ghana, mobile money volume of transactions increased to 5.07 billion in 2022, from 4.25 billion in 2021, representing a 19.30 percent growth. Active mobile money customers and agents also recorded a corresponding growth of 13.55 percent and 14.20 percent. Float balances held by banks increased by 34.10 percent as internet banking transactions increased by 43.03 percent.

Market constraints

The challenge for FinTech firms is how to expand and grow the customer base. Financial services are growing in value and number of transactions, but not in terms of the enrollment of new customers. According to the Global Findex, 26 percent of unbanked adults in Ghana say they do not have an account. They use informal intermediary forms of payments. The 2022 Global Findex report also mentions a large gender gap in FinTech adoption. The report suggests a double-digit gap (10 percentage points) between women and men and that women cite mobile phone ownership as a barrier.

Another yawning gap persists between the southern and northern regions, with the latter recording the lowest number of registered mobile money customers since 2017, despite gradual infrastructure improvements. In the long run, these disparities have a tendency to hamper growth.

The governor of the BoG argues that innovation and expansion of services will close these gaps. He believes that technology has paved the way for access to financial services. He hammered this point on January 27th, 2023, in a speech during the “FinTech 2022 Awards”. Extending his analysis of the prospects for the industry, he urged FinTech companies to venture into other areas of the economy. For the governor, “agriculture, manufacturing, distribution, transportation, retail, and wholesale require user-centric solutions to make any meaningful impact”.

Related Articles

BIBLIOGRAPHY

1❩https://www.bog.gov.gh/wp-content/uploads/2023/02/FAQs-Regulatory-sandbox_New-Communications.pdf

2❩https://www.bog.gov.gh/wp-content/uploads/2022/07/Payment-Systems-Oversight-Annual-Report-2021.pdf

3❩World Bank (2022): Financial Inclusion, Digital Payments, and Resilience in the Age of COVID-19 - Global Findex Database, 2021.

4❩ibid