Ghana: US companies Who's Who

Bob Selasi Esinam, London, UK

April 25, 2024

G hana is the fifth largest commercial partner of the United States in Sub-Saharan Africa (after South Africa, Nigeria, Kenya and Angola1). American companies play an important role in the economy of Ghana, though their subsidiaries or through short-term project implementation presence. Ghana has 15 active economic sectors and US companies are present in 13 of them, making it one of the largest private business presence of the OECD2 countries. Ghana needs to attract more US companies to benefit from direct investments, transfer of technology and modern skills.

Trade instruments

The United States promotes international trade through various trade instruments and by deploying institutions on the ground. In July 2018, the US added Memorandum of understanding (MOU) to the constellation of existing agreements on trade between Ghana and the United States. During an official visit to Ghana, US Secretary of Commerce, Wilbur Ross, and the Ghanaian Finance Minister, Ken Ofori-Atta, signed a MOU, which outlined investment and trade opportunities in key economic sectors. The MOU targets extractives, transport infrastructure, agriculture, health care and technology. It also set up a forum for addressing trade barriers that continue to limit U.S. companies’ abilities to invest in Ghana.

Ghana has other trade arrangements with the United States. For example, the U.S. and Ghana signed a Trade & Investment Framework Agreement (TIFA) in 1999. TIFA monitors trade and investment relations and facilitates an ongoing dialogue to help increase commercial and investment opportunities. This framework tries to identify and remove impediments to trade and investment between the United States and Ghana3. Ghana and the United States signed an agreement on Investment Guaranties during the same year. The agreement eliminates a double approval process for investment from the Development Finance Corporation-DFC (formerly Overseas Private Corporation or OPIC)4.

Ghana and the United States have a bilateral ‟Open Skies Agreement”, which facilitates international air transport and encourages the development of air transport and services between the two countries5. The country also meets eligibility requirements for the African Growth and Opportunity Act (AGOA), the Generalized System of Preferences (GSP), and qualifies for the apparel benefits under AGOA.

Ghana complements these agreements with guarantees that protect US companies from illegal expropriation and nationalization6.

Ghana’s attractiveness

In May 2023, Ghana defaulted on its domestic and international debt payments and started a restructuring program with creditors. The decision followed two years of macroeconomic turbulence characterized by high inflation, depreciating currency and severe fiscal imbalance. According to the Overseas Development Institute and the German Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ), this macroeconomic instability has created ‟serious constraints on business, and investment activities, potentially lowering Ghana’s attractiveness as an investment destination”7.

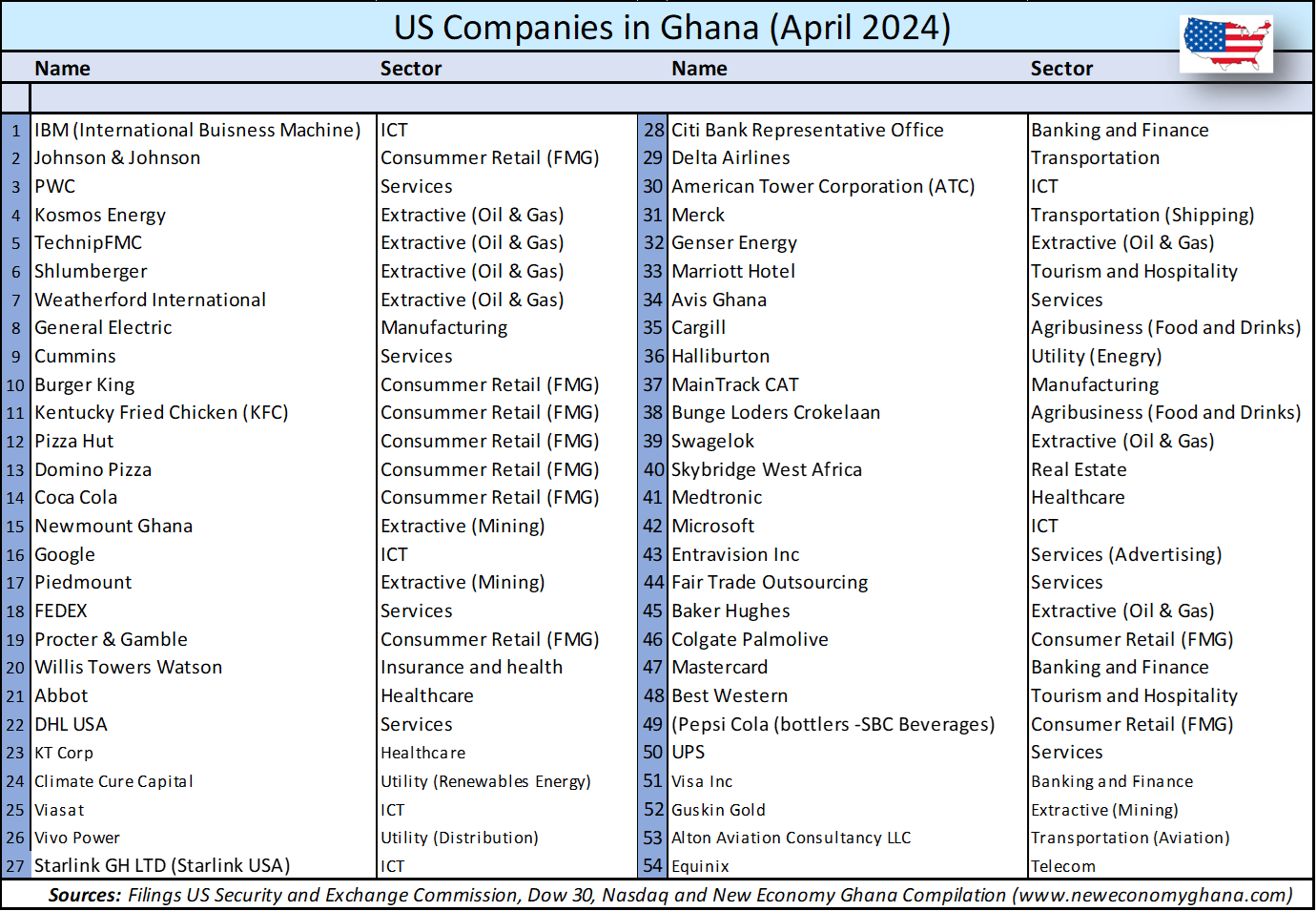

However, despite the economic turmoil, Ghana’s political stability and its competitive liberal economy continue to sustain its appeal. Since 1992, Ghana has built a stable democratic system, which has resulted in 30 years of uninterrupted democratic leadership. Ghana ranks as the second peaceful country in West Africa (After Sierra Leone), according to the 2023 Global Peace Index. Also, despite the dominance of the extractive and agricultural sectors, the economy is diversifying with a thriving manufacturing industry and growing services sector. The US Department of State estimates that Ghana’s major sectors are open to foreign capital participation8. In 2024, more than 54 US companies had registered subsidiaries in Ghana, while 44 maintained a temporary or indirect presence for specific projects.

US Companies in Ghana

www.neweconomyghana.com

Emerging opportunities for US companies

Opportunities exist in traditional sectors such as agriculture, extractive (mining oil and gas), financial services and ICT (digitalization). Ghana continues to attract US franchises in the restoration and hospitality industries. Also, Ghana’s developing healthcare system, tourism sector, and transport infrastructure (roads, rail, air, shipping, and port infrastructure) offer opportunities for U.S. companies. Ghanaian authorities are looking for investors to expand the capacity of the country’s major seaports. They have also launched a call for interest for third deep seaport in the coastal town of Keta in South-Eastern Ghana.

Besides infrastruture, Ghana the mass consumer market is going through a dynamic transformation, which creates commercial opportuniries. Consumer habits are changing, especially with the under-25s, who make up over 50 percent of the population. Family links with the diaspora in the United States, social media, and the ubiquity of US culture contribute to the popularization of US products and brands. Ghana hosts the headquaters of the new African Continental Free Trade Area Secretariat (AfCFTA). The country is, therefore, at the heart of Africa’s transformative regional integration.

Challenges

Ghana is a signatory to major international trade agreements, including the World Trade Organization (WTO) and the General Agreement on Tariffs and Trade (GATT). As a member of the WTO, Ghana takes part in the Trade Policy Review Mechanism (TPRM), a peer review mechanism that regularly analyzes the trade policies of WTO members. The 2022 WTO review urged Ghana to address the challenges investors are facing in areas such as customs procedures. Other areas of concern to the WTO are transparency in taxation and the law pertaining to the minimum foreign investment requirements.

In Ghana, US companies must be ready to work in an environment without a Bilateral Investment Treaty (BIT) or a Free Trade Agreement (FTA). The US and Ghana do not have a double taxation treaty either. Also, US companies must, alone, ensure compliance with the Foreign Account Tax Compliance Act (FATCA) which Ghana has not signed. However, Ghana allows banks or foreign financial institutions (FFIs) in Ghana to report information to the United States Internal Revenue Service.

According to the International Trade Administration (ITA), one of the major key constraints to US commercial presence is the cost and availability of power. Also, with commercial lending rates hovering around 29 percent (Q2 2024)9, US-based exporters looking for financing inside Ghana will be at a disadvantage. Against these reservations, the Ghanaian government highlights the country’s transformative agenda. This new vision, the authorities argue, is improving and turning the country into a competitive business environment.

Related Articles

BIBLIOGRAPHY

1❩ https://www.usitc.gov/publications/332/pub3476.pdf

see also Office of the US Trade Representative 2019. https://ustr.gov/countries-regions/africa

2❩ Organization for Economic Co-operation and Development

3❩ https://ustr.gov/united-states-and-ghana-chart-course-cooperation-trade-and-investment

4❩ https://www.state.gov/wp-content/uploads/2019/02/13023-Ghana-Investment-Guaranties-February-26-1999.pdf

5❩ James P. Rubin - US Department of States (2000): U.S., Ghana Initiate Open Skies Partnership - https://1997-2001.state.gov/briefings/statements/2000/ps000317c.html

6❩ https://www.gipc.gov.gh/incentives-and-guarantees/

7❩ Sherillyn Raga (Feb 2023): Ghana: macroeconomic and trade profile – Joint Policy Brief by the Overseas Development Institute and the German Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) - http://cdn-odi-production.s3-website-eu-west-1.amazonaws.com/media/documents/Ghana_macroeconomic_and_trade_profile_2023_final.pdf

8❩ US Department of State (2023): Investment Climate Statement 2023 - https://www.state.gov/reports/2023-investment-climate-statements/ghana/

9❩ https://www.bog.gov.gh/quarterly_bulletin/quarterly-economic-bulletin-2023-q3/