Access to insurance services: Still a privilege for a few

Adama Bukari, Accra, Ghana

May 17, 2024

A 2021 report from the United Nations Development Program (UNDP) reveal that 70 percent of Ghanaians have no access to insurance1. They have no protection against natural hazards, casualties, and recurrent natural disasters. Also, data from the Ghana National Insurance Commission (NIC) showed a rate of insurance penetration of 1.14 percent in 2021. But pension data increases this penetration rate to 3 percent. Insurance penetration is the contribution of total insurance premiums to gross domestic product (GDP). The insurance sub-sector in Ghana concentrates in urban southern areas, while the Northern and Savana regions have the lowest access to insurance. Data also shows a yawning gender divide with women recording the lowest access to insurance.

Insurance is important for households and small businesses, especially in a context where climate change. Global warming increases the risk of fire, floods, coastal erosions, and drought. Floods, for example, spread waterborne diseases, while coastal erosions cause internal displacements of people.

The landscape

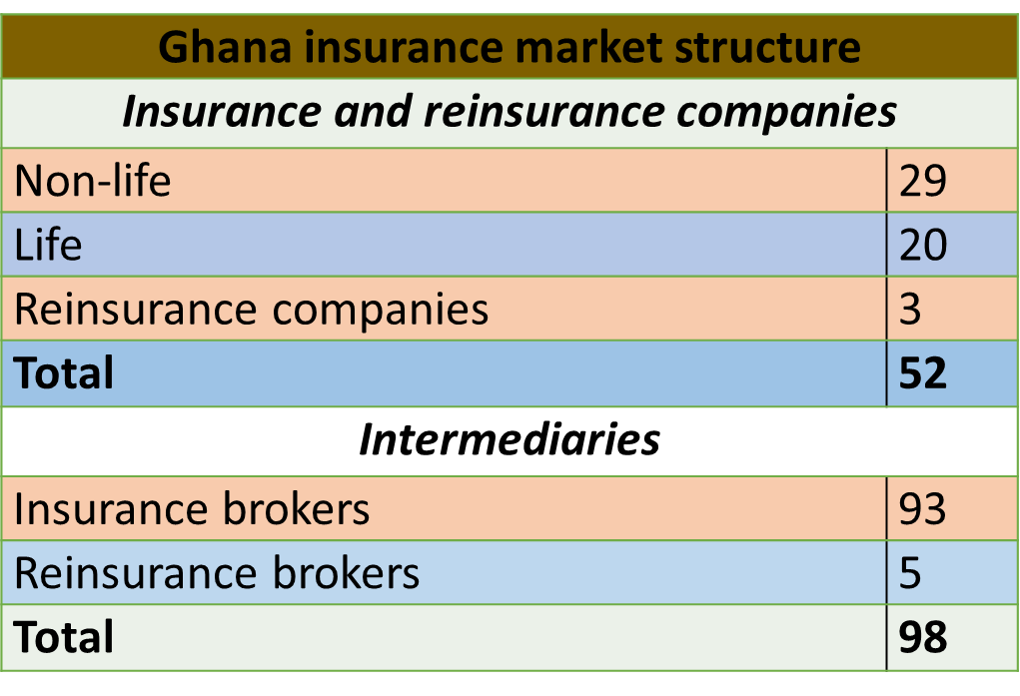

The State provides primary social safety nets through the national health insurance service (NIHS). This service is available in rural areas2. But rural areas have little access to private insurance services and products. The government is seeking to improve access to insurance through the development of micro-insurance targeting low-income households. The industry has 98 market participants, which together generated a turnover of US$800 million in 2021.

Source: National Insurance Commission

The industry is growing, albeit at a slow pace. Total industry premium income was US$414.7 million (GH₵5.2 billion) in 2021 compared to US$334.9 million (GH₵4.2 billion) in 2020. Non-life accounted for 51.9 percent (US$215.3 million or GH₵2.7 billion) while the life insurance generated US$199.3 million or GH₵ 2.5 billion (48.1 percent)3.

Data from the National Insurance Commission show a cumulative average growth rate of the insurance industry of 25 percent, over the last eleven years (2010-2021). However, total assets of the insurance industry have stagnated. In 2021, the insurance sub-sector only contributed 4 percent of the total asset of the entire financial sector, with assets valued at US$22.8 billion (GH₵259 bn). Demand barriers include perceived low value of insurance, lack of trust in insurers and a misalignment between supply of insurance products and needs4.

Emerging risks

Ghana loses the equivalent of 1.6 percent of GDP annually US$165 million (GH₵1.00 billion) to road accidents and spends US$3.5 million (GH₵40 million) to fight fire across the country. On average, floods affect 45,000 people every year, costing the country (US$98.6 million)5.

In the agricultural sector, every year, drought destroys 13 percent of the country’s livestock, causes crop failure and low yield. Crops also suffer from the invasion of pests, which prosper during extended drought, leading to a decrease in production and an increase in the use of expensive and dangerous pesticides. Other socio-economic risks include natural disasters (for example: land slide, tornadoes, oil spills), lay off from work, business failure, death of a family member or close relative and health issues.

Ghana also faces new emerging risks, such as cybercrimes that have devastating economic and financial consequences on institutions, businesses, and households and individuals. The country is digitalizing the delivery of public and private commercial services. These new technologies increase productivity and profitability. But technological progress exposes companies, state institutions and individual to cyber-attacks. Potential risks include data theft, extortion, and operational disruptions.

State institutions offer a basic level of protection in the health sector. For example, the National Health Insurance Service (NHIS)6 provides minimum health cover to 68.6 percent of the population. But, according to the UNDP, Ghana has no known sovereign risk transfer solutions. During disasters, the Environmental Protection Agency (EPA) and the National Disaster Management Organisation (NADMO) offer ex-post interventions. These institutions have expertise but limited resources. The government only budgeted US$4 billion between 2021 and 2024 for the fight against natural disasters.

Related Articles

BIBLIOGRAPHY

1❩ UNDP (2021): 70% of Ghanaians have no access to insurance, UNDP report reveals 70% of Ghanaians have no access to insurance, - https://irff.undp.org/sites/default/files/2022-09/summary-country-diagnostic-ghana_0.pdf

2❩ Figures from the Ghana Statistical Service 2021 census results report 68.6 % of the population is covered by either the National Health Insurance Scheme (NHIS) or private health insurance schemes. There is a higher rate of health insurance coverage for females (72.6%) than males (64.5%)

3❩ GCB (2023): Sector industry report 2023 - https://www.gcbbank.com.gh/research-reports/sector-industry-reports/397-insurance-industry-in-ghana-august-2023-1/file

4❩ National Insurance Commission and GIZ (2020): Public perception, awareness and confidence of insurance in Ghana - https://www.findevgateway.org/sites/default/files/publications/submissions/67311/20200311_Assessment%20of%20Public%20Perception%2C%20Awareness%20and%20Confidence%20in%20Insurance%20in%20%20Ghana.pdf

1❩ UNDP ibid.

1❩ Figures from the Ghana Statistical Service 2021 census results report 68.6 % of the population is covered by either the National Health Insurance Scheme (NHIS) or private health insurance schemes. There is a higher rate of health insurance coverage for females (72.6%) than males (64.5%)