Fertilizers: ‟I support a regional approach” - Faure Eyadema, President of Togo

Megan Ocloo, London, UK

June 2, 2024

I n West Africa, the agricultural sector is a major source of employment for 70 percent of the population or over 290 million people. According to research from the United Nations Food and Agricultural Organization (FAO), the sector contributes 35 percent of the regional gross domestic product (GDP). Small scale rural farming dominates the sector and productivity is declining because of the vagaries of climate change. Dysfunctional and under-developed linkages between farmers and markets and an asymmetry of information on new agricultural technologies continue to inhibit the sector. West African regional institutions have policies and initiatives which seek to transform the sector, but countries struggle to enforce regional agricultural policies at the national level. The result is worsening malnutrition and hightened risk of famine in the region. Regional policies on fertilizer exemplify the challenge the sector continues to face.

United, we are stronger

The Economic Community of West African States (ECOWAS) members have agreed to combine their resources and synchronize their agricultural policies. They plan to focus on fertilizers, which they believe are a critical factor that will yield rapid outcomes and lasting positive effects in the sector. This was the message of the ministers of agriculture and finance from West Africa, when they gathered for a high-level roundtable in Lomé on May 30th and 31 2023. The ECOWAS, the Togo President, the World Bank, and the International Fertilizer Development Center (IFDC) co-hosted the event1.

During the roundtable, the West African Heads of State and ministers promised investments and announced a common roadmap2. The goal of the roadmap is to make fertilizers accessible and affordable across the region.

President Eyadema during his welcome speech

Source: Togo Presidency

The President of Togo declared in an opening speech, that ‟our vision should primarily be sub-regional”3 because ‟no single country in the sub-region holds the keys to a complete fertilizer value chain”. Collectively, West Africa’s wealth holds out the promise of sovereign production of inputs thanks to the region's natural gas and phosphates. The road map contains goals and metrics, which seek to triple the consumption of fertilizers and to double agricultural production by 2035. An improved access to fertilizers, especially for small-scale farmers and to climate resilient crops is also a part of the road map.

Participants to the roundtable promised to eliminate customs duties and taxes, to improve quality control and also traceability. One major recommendation invites countries to boost investments in transport, shipment, and storage infrastructure. Multilateral and continental financial institutions (World Bank Group, The African Development Bank, Afreximbank) promised trade finance and insurance facilities.

West Africa fertilizer map

The region imports 90 percent of the fertilizer it consumes4 even though it has vital natural resources necessary for the production of this input. Senegal and Togo rank as countries with the largest potential deposits of phosphate in the world (reserves estimates are 2 billion tons each)5. Other countries in the regions with phosphate deposits are Benin, Burkina Faso, Mali, Niger, and Nigeria. Liberia and Guinea Bissau also have modest deposits.

The region also has huge deposits of natural gas, which is another essential input for the production of fertilizer. Nigeria has 206.53 trillion cubic feet of reserves. Senegal follows with over estimated 100 trillion cubic feet, Cote d’Ivoire (1 trillion cubic feet) and Ghana (0.80 trillion cubic feet).

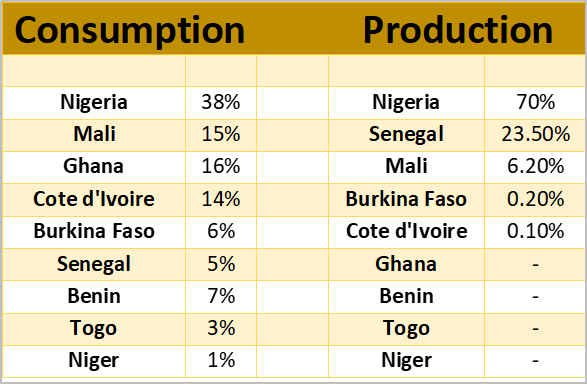

Consumption

The average rate of inorganic fertilizer application in West Africa is 20 kg per hectare. In subsistence farming in rural areas, natural compost is the dominant form of soil nutrients. The target, according to the 2006 Abuja Declaration (a continental strategy to reverse the worrying trend of poor productivity of the African soils), was to reach 50kg per hectare and per year of nutrients6.

In West African countries, the rate of fertilizer application depends on crops and the fertility of the soil in different regions. Nigeria is the largest importer and also the largest consumer in the region. However, Nigeria underperforms when compared to peer economies such as South Africa and Egypt, where fertilizer use average 100 kg per hectare. Mali, Ghana, and Cote d’Ivoire absorb 45 percent of the fertilizer available region. These three countries also have low fertilizer application rates.

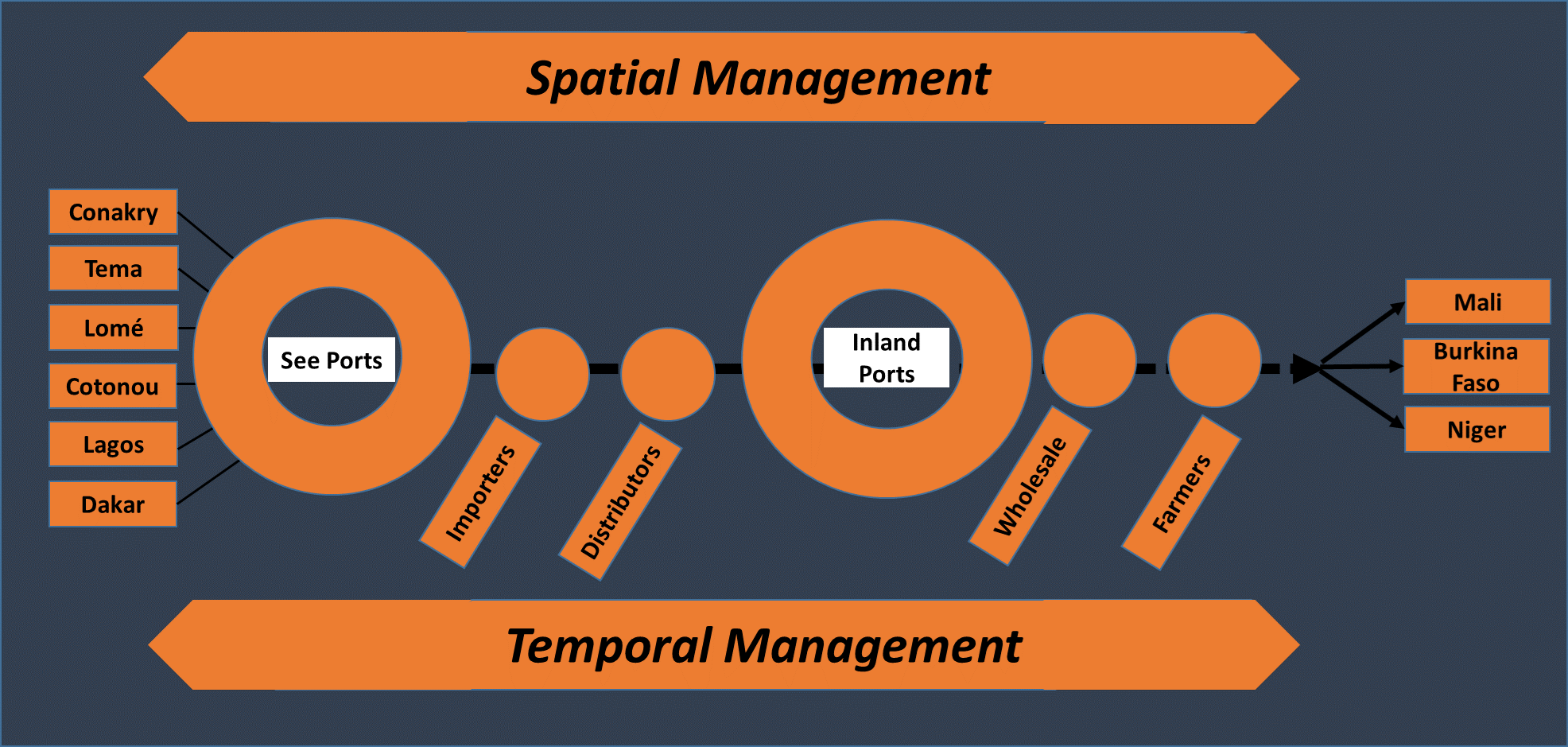

Cost and availability are the main reason for the low consumption. According to the U.S. Agency for International Development (USAID)7, fertilizer logistics and especially road transport are important components in the determination of fertilizer prices. Transport and storage charges increase cost for land-locked countries such as Niger, Burkina Faso, and Mali.

Production

In 2022, the USAID identified 108 fertilizer plants (an increase of 21 from the 2021) in West Africa. They included 11 fertilizer production plants, one micronutrient production plant and one lime supplements production plant. USAID survey also recorded 17 organic fertilizer plants and 78 blending facilities8. The Dangote and Indorma plants, which produce urea and Ammonia are based in Nigeria are the largest production facilities in the region. In 2022, nine countries in West Africa produced 3.8 million tons of organic and inorganic fertilizers. But, demand outstrips supply and import cannot close the gap. The lack of investment hampers production, especially in the absence of adequate funding commitments from national government and regional institutions.

Investors continue to face inadequate regulation, fragmented and complex downstream distribution chain characterized by inadequate transport, storage and distribution logistics. Banks show little interest in funding fertilizer ventures because of perceived risks of crop seasonality, the risks of failure associated with rain-fed farming and the vagaries of climate change. From the demand side, the dispersion of farmers exacerbates the chronic asymmetry of information of the West African agricultural sector.

Apparent inorganic fertilizer consumption and production

Source: ifdc.org

Import substitution initiatives

Ghana wants to produce fertilizers to meet domestic demand. Private companies are producing and selling organic fertilizers made from compost. However, quality, capacity and marketing networks suffer from various dysfunctions.

Additional assistance tends to come from development aid from donors. For example, in September 2022, the United States offered US$2.5 million to supply fertilizers to 100,000 small holders in the 20229. This initiative was a partnership between USAID and Yara, a multinational fertilizer producer. USAID then implemented the project with the Alliance for a Green Revolution in Africa (AGRA) and the African Fertilizer and Agribusiness Partnership (AFAP). Together, they delivered 360,000 bags of Yara fertilizers to farmers.Donor programs and state subsidies are not long-term solutions to the country's needs. A promising sustainable solution is a manufacturing and production project nurtured by Ghana and Morocco. In September 2018, the Ghana Ministry of Food and Agriculture (MoFA), and the Morocco OCP Group10 signed a Memorandum of Understanding (MoU) to develop a fertilizer plant in Ghana. On September 5th, 2019, the two parties signed two additional agreements, to conduct soil mapping and a digital registration of farmer. They also signed a term sheet for the financing for the plant. The MoFA is upbeat about the project. In a statement, the MoFA announced that the plant will ‟provide access to the quality inputs at a competitive price”11.

The US$2.00 billion plant (estimates) will be based in Jomoro’s district (Western region) and have a production capacity of one million tons. Ghana will supply natural gas, while phosphate will come from Morocco.

New challenges and opportunities

Since the Abuja declaration in 2006, production has risen because of new plants in Nigeria, but the application rate remains stagnant at around 20kg per hectare. The African Union, the ECOWAS, and multilateral development banks continue to develop and fund programs and projects to increase the availability of fertilizers in West Africa. Despite these contributions, the region continues to depend on import, subsidies and also on multilateral and bilateral programs. These are evidence that the West Africa regional fertilizer program has not yielded the expected results.

New challenges and also opportunities have emerged. Scientists are raising the alarm about the contribution of fertilizer production to global greenhouse emissions. According to researcher at the MIT, ‟fertilizers also produce greenhouse gases after farmers apply them to their fields”12. The production of nitrogen alone accounts for ‟approximately 5 percent of global greenhouse gas (GHG) emissions”13. Fertilizer production also faces challenges at the level of infrastructure and logistics. When importers offload fertilizers from the ports, logistics add between 25 percent to the costs, by the time they reach farmers. This is because of the inadequacy of existing logistics and the cost of fuel. Land locked countries end up paying more than their coastal neighbors.

Apparent inorganic fertilizer consumption and production

Source: Adapted from ifdc.org

Science and technologies are creating opportunities and addressing the challenges the fertilizer industry continues to face in the region. Biotechnology and artificial intelligence are introducing efficiency and sustainable ways of using mineral and organic fertilizer inputs that enhance soil health. Mobile technologies are connecting farmers and creating market and innovative financing linkages. Satellite, GPS, and drone data generate accurate information on soil health and help in the monitoring of the timely effectiveness of fertilizer application. Artificial intelligence helps to analyze these data (complexe analysis of data from GPS mapping, soil, climate and crops) and make accurate predictions on how plants respond to inorganic or organic nutrients and also changed in climate.

But individual countries need to align domestic policies to regional initiatives and remove borders to coordinate quality control and facilitate the involvement of regional private investors.

Related Articles

BIBLIOGRAPHY

1❩ World Bank (2023): https://www.worldbank.org/en/events/2023/05/11/high-level-roundtable-fertilizing-west-africa-feeding-the-soil-to-feed-the-people

2❩ https://thedocs.worldbank.org/en/doc/35380715cfe0b7564a1bb6d294594693-0360012023/original/Roadmap-English.pdf

3❩ Faure Gnassingbé Eyadema (2023): Speech by the Head of State at the International Round Table on Fertilizers and Soil HealthAllocution du chef de l’Etat à la Table ronde internationale sur les engrais et la santé des sols (June 1st 2023) -

Translated from French. -

https://presidence.gouv.tg/2023/06/01/allocution-du-chef-de-letat-a-la-table-ronde-internationale-sur-les-engrais-et-la-sante-des-sols/

5❩ IFDC (2023): Fertilizer Logistics in West Africa - https://ifdc.org/2021/02/26/fertilizer-logistics-in-west-africa/)

5❩ FAO (2004): Deposits of phosphate around the world - https://www.fao.org/4/y5053f/y5053f06.htm

6❩ NEPAD (2015): Status report on fertilizer use: progress but still below Abuja target - https://www.nepad.org/news/status-report-fertilizer-use-progress-still-below-abuja-target

7❩ USAID (2017): West Africa business information map - https://ifdc.org/wp-content/uploads/2020/03/Project1_Final_WAFBIM-EN.pdf

8❩ USAID ibid.

9❩ https://gh.usembassy.gov/u-s-announces-emergency-fertilizer-assistance-for-smallholder-farmers/#:~:text=Techiman percent2C percent20Ghana percent20 percentE2 percent80 percent93 percent20The percent20U.S. percent20Government,fertilizer percent20for percent20this percent20planting percent20season

10❩ With almost a century of experience and revenues reaching US$ 5.95 billion, 23,000 employees in 2018, OCP Group is a leader in the phosphate rock and the world’s first producer of phosphate-based fertilizers.

11❩ https://ocpsiteprodsa.blob.core.windows.net/media/2020-10/OCP percent20MOFA percent20- percent2005_09_2019.pdf

12❩ MIT Climate Portal (2021): Fertilizer and Climate Change- https://climate.mit.edu/explainers/fertilizer-and-climate-change

13❩ Yunhu Gao and André Cabrera Serrenho (2023): Greenhouse gas emissions from nitrogen fertilizers could be reduced by up to one-fifth of current levels by 2050 with combined interventions – Research in Nature Food - https://www.nature.com/articles/s43016-023-00698-w#:~:text=Food%20security%20relies%20on%20nitrogen,whole%20life%20cycle%20of%20fertilizers.