Wheat: Rude awakening for Ghana’s loaf

Paul Appiah, Accra, Ghana

January 04, 2024

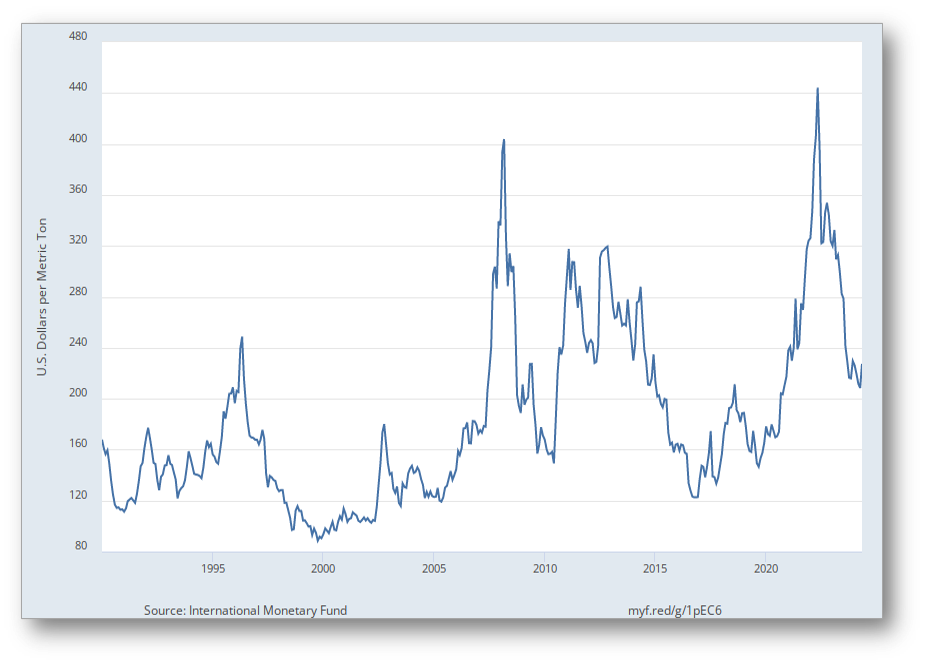

S ince 2020, the average price of a loaf of fresh white bread (500g) has increased by 31.2 percent. The supply and demand dynamics, shipping, and also the price of substitutes and climate factors added 50 percent to the price of wheat between 2020 and 2022. Specifically, energy costs multiplied manufacturing costs for milling facilities and bakeries by three. Every product which use wheat as component recorded an increase from 2020. This is has been the case for biscuits, pasta, and instant noodle. Analysts forecast further increase in demand because of population growth and urbanization.

Wheat Import

Wheat is a staple food in Ghana, appearing in a wide variety of items. Four wheat milling companies operate in Ghana. They are GAFCO, Irani Brothers, and Golden Spoons Ltd and Takoradi Milling Ltd. Their major clients are manufacturers of bread and pastries, as well as biscuit. The total wheat milling capacity in Ghana is 2,200 metric tons a day.

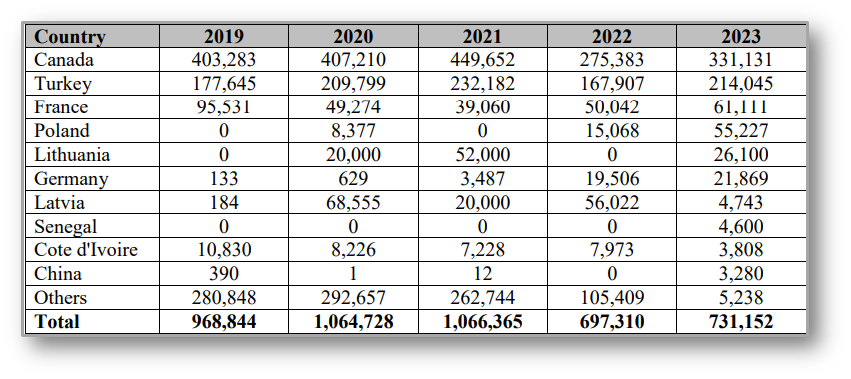

Ghana imports the totality of domestic consumption and Wheat ranked as Ghana’s 12th imported product in 2022 and 2023. The major suppliers were Canada (US$147 million), Russia (US$58.2 million), Lithuania (US$14.6 million). Other suppliers included France (US$10.5 million), Ukraine (US$10.1 million) and Turkey1. The USDA estimates that the country will consume 850,000 metric tons in 2024 and 900,000 in 2025. Dependency on import exposes the country to price fluctuations on the international market. At home in Ghana, other price determinants include rising utility tariffs, rapid inflation, and Cedi depreciation.

Global wheat price (USD per metric ton)

Source: Federal Reserve St Louis

Alternatives to wheat

Import substitution is a key component of the government’s food security policy. This is because continued increase in the price of imported food commodities has a negative macroeconomic impact, notably with the pressure it exerts on foreign exchange reserves and food inflation. For these reasons, the food industry of Ghana and consumers are starting to seek alternatives to wheat. Sorghum, millet, and fonio have received attention as suitable alternatives. Similar interest is developing with other popular sources of flour such as cassava and yam.

Sorghum

Sorghum is a tropical crop indigenous to Africa. After maize, sorghum is the second staple cereal in West Africa. Sorghum tolerates droughts and survives with low irrigation in Ghana’s northern Savanah areas. This crop generates 12 percent of total cereal production in the country. Ghana produced 333,440 metric tons of Sorghum in 2023, ranking the crop as the third source of flour, after maize and rice.

Millet

Millet flourishes in semi-arid tropical areas and also thrives in damp conditions prevalent in the Savanah and the Northern regions, which are the two hubs of production in Ghana. With its short growth season, it has a potential for rounds of harvest per year. Ghana produced 196,308 metric tons of millet in 2022.

Fonio

The volatility of the price of wheat has reignited interest in fonio. This crop is native to Ghana and adapts well to the country’s climate. Fonio is drought resistant and grows in dry locations with minimal irrigation. Esther Ama Asante, a Ghanaian entrepreneur, describes fonion as ‟an ancient super food”. Asante is the founder of the Organic Trade and Investments (OTI)2. Like millet, fonio is native to Ghana and has a short growing season (60-70 days). These crops have high nutritional value and a wide economic outlet according to the Food and Agricultural Organization (FAO)3.

Bilateral and multilateral donors are showing interest in the potentials of fonio. In March 2024, the FAO teamed up with women groups to boost fonio production in the North4. In May 2024, the USAID invested US$742,000 (GH₵10.8 million) in fonio production in Northern Ghana. The goal is to increase food security and improve farmers’ livelihoods5.

Cassava and yam

Cassava and yam hold a distinct place on our list of potential alternatives to wheat. These two crops are adaptable and popular source of starch in sub-Saharan Africa. Cassava farmers are expanding into industrial products, with products such as as biodegradable plastics, ethyl alcohol and modified starches.

Other commercial products derived from cassava and yam include sugar syrups and flour6. They have health benefits because of the low level of gluten-free. These properties make cassava and yam viable substitutes for wheat. According to data from the Ghana Export Promotion Agency (GEPA), Ghana produced 3,400 metric tons of high-quality cassava flour in 2020, more than twice as much as in 2016. Ghana is Africa’s second producer of yam after Nigeria.

Top 10 Suppliers of Wheat to Ghana (Metric tons)

Source: USDA with data from Trade Data Monitor LLC, 2024

Researchers have shown that baking cassava flour can be used to substitute for up to 30 percent of wheat flour in bread, 40 percent in biscuits and 100 percent in cake without adverse consumer responses7. Sorghum flour, when incorporated at low levels with wheat flour (10 percent to 20 percent), creates bread of comparable quality to wheat flour8.

Related Articles

BIBLIOGRAPHY

1❩ Ghana: Import and export - https://atlas.cid.harvard.edu/countries/83/export-basket

2❩ http://www.oti-gati.com/

3❩ FAO (2013): Save and grow cassava - https://www.fao.org/3/i3278e/i3278e00.pdf

4❩ FAO (2024): FAO and chef Fatmata Binta announce new project to empower women fonio producers in Ghana - https://www.fao.org/newsroom/detail/fao-and-chef-fatmata-binta-announce-new-project-to-empower-women-fonio-producers-in-ghana/en#:~:text=Fonio%2C%20an%20ancient%2C%20nutrient%2D,its% 20nutritional% 20and% 20environmental% 20benefits.

5❩ USAID (2024): U.S. Invests Ten Million Ghana Cedis in Sustainable Fonio Production to Increase Food Security and Economic Opportunities in Ghana’s North - https://gh.usembassy.gov/u-s-invests-ten-million-ghana-cedis-in-sustainable-fonio-production-to-increase-food-security-and-economic-opportunities-in-ghanas-north/

6❩ FAO (2020): Sustainable livelihoods: new market opportunities for cassava, https://teca.apps.fao.org/teca/en/technologies/4575

7❩ Sibanda, T.; Ncube, T.; Ngoromani, N. Rheological properties and bread making quality of white grain sorghum-wheat flour composites. Int. J. Food Sci. Nutr. Eng. 2015, 5, 176–182.

8❩ Dube, N.M.; Xu, F.; Zhao, R.; Chen, J. Effect of using Zimbabwean Marcia sorghum and high-gluten flour on composite bread specific volume. J. Food Process. Preserv. 2021, 45, e15367.