Bond market landscape after the DDEP

Aboubakar Chira Dabisa, Littlerock Arkansas, USA

January 19, 2024

T he government of Ghana remains the largest bond issuer in the country, with over 50 percent of the market. This includes the Bank of Ghana, which issues of debt instruments in its own name and on behalf of the Government of Ghana. State-owned companies such as the Ghana cocoa board (Cocobod) also have the authority to issue debt instruments, in this case for the purchases cocoa during the crop season. The State issues bonds in cedi and also in US dollar, which are accessible for domestic and foreign investors.

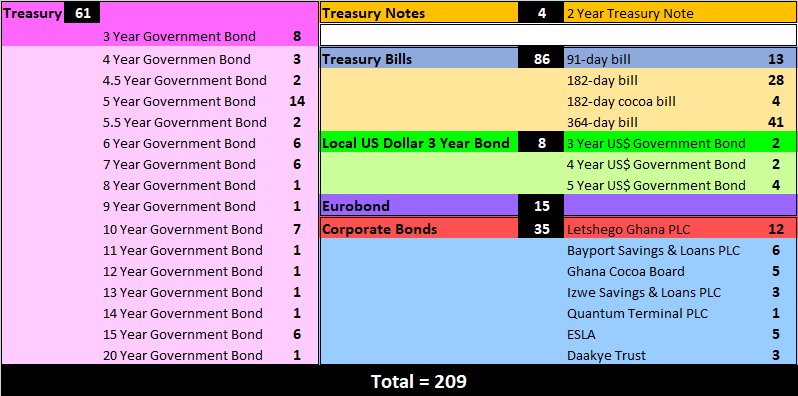

Data from the Ghana Fixed Income Market (GFIM- The country's fixed income exchange) show that the exchange had 209 listed debt securities in January 2024 (compared to 199 in December 2022). This includes 35 corporate bonds, 151 Ghana Government instruments (Bill, Treasury, and Notes), 15 Eurobonds and 8 US dollar denominated domestic bonds.

Bond Market: Listed Instruments

Mechanism

On 5th December 2022, the Government of Ghana launched Ghana’s Domestic Debt Exchange program. The program was an invitation for a voluntary exchange of US$11.4 billion (GHS137 billion) of the domestic notes and bonds, for a package of new bonds. The domestic debt portfolio contained marketable securities and non-marketable securities and arrears. The government offered bondholders lower coupons and longer tenors.

The government announced the results of the exchange on September 26th, 2023. At the closure of the first round, 85 percent of bonds holders had taken part in the exchange. Banks, non-financial institutions, insurance firms, and asset managers had subscribted to the offer. Other participants included pension fund trustees, private institutions, and individuals. Before the exchange, residents held 47.7 percent and non-residents 2.2 percent.

Initial Overview of DDEP exchange 3

The DDEP has not changed the demographic distribution of the holdings. Thus, domestic debt will continue to be part of the government liabilities until they reach the maturity.

Short-term pain, long-term gain

The DDEP sent positive signals to the market and paved the way for agreements with the IMF and with international creditors. But, the DDEP also had an immediate negative impact, for example, on banks. The Ghana Association of Banks revealed net impairment losses on financial assets in the sector of US$1.34 billion (GH₵19.5 billion) in 2022. The IMF estimates that at 16-18 percent discount rate, the last terms of the DDEP imply an average net present value (NPV) reduction of 30 percent for bondholders. However, upon completion, the DDEP also produced large cash debt relief for the government of US$4.3 billion (GHS 50 billion) in 2023, relieving pressure on the domestic financing market.

Outlook

The domestic debt market came to a complete halt after Ghana suspended debt payment and announced a restructuring in the middle of a tumultuous macroeconomic crisis.

In the aftermath, Ghanaian authorities were able to contain the ambient uncertainties by reassuring the market over the future of the domestic debt market. During an IMF press briefing on Ghana May 24th, 2023, Ernest Addison, the Governor of the Bank of Ghana, lauded the DDEP as a ‟clear demonstration of burden sharing”. In the same vein, Ken Ofori-Atta, Minister of Finance lauded the ‟forbearance of all Ghanaians in the wake of the domestic debt exchange program ” which he described as ‟difficult but, ultimately, a necessary exercise”6.

But, a bearish sentiment continues to dominate Ghana’s domestic bond market. In June 2023, trading regained momentum, although it has not yet reached the pre-DDEP. Non-resident holding of outstanding debt remains below the 2021 average of 20.1 percent and was 9 percent at the end of March 2023. In Ghana, analysts used the rate of non-resident holding as an informal indicator of confidence in Ghana’s economy. But expectations are that the domestic debt market will resume when the country shows a sustainable improvement in economic fundamentals.

Related Articles

BIBLIOGRAPHY

1❩ https://www.csd.com.gh/services/it-disaster-recovery-plan/27-depository-services/auction-system/31-products.html#:~:text=Bank percent20of percent20Ghana percent20on percent20behalf percent20of percent20, the percent20auction percent20module percent20attached percent20to percent20the percent20main

2❩ Ministry of Finance (2022): Government of Ghana Domestic Debt Exchange: Potential Financial Sector Impacts and Mitigating Safeguards - https://mofep.gov.gh/press-release/2022-12-29/government-of-ghana-domestic-debt-exchange-potential-financial-sector-impacts-and-mitigating-safeguards

3❩ https://mofep.gov.gh/sites/default/files/basic-page/Ghana-Investor-Presentation.pdf

4❩ PWC (2023): Post-DDEP: how do banks intend to build back? 2023 PwC Ghana Banking Survey Report - https://www.pwc.com/gh/en/assets/pdf/ghana-banking-survey-report-2023.pdf#:~:text=The%20dynamics%20of%20government%20debt%2C%20including%20its,manage%20their%20exposure%20and%20mitigate%20potential%20risks.

5❩ IMF (2023): Ghana: Request for an Arrangement Under the Extended Credit Facility—Debt Sustainability Analysis - https://www.elibrary.imf.org/view/journals/002/2023/168/article-A002-en.xml

6❩ International Monetary Fund – IMF (2022): Request for an arrangement under the extended facility – Debt sustainability analysis. - https://www.elibrary.imf.org/downloadpdf/journals/002/2023/168/article-A002-en.pdf

6❩ International Monetary Fund – IMF (2023): Transcript of IMF Press Briefing on Ghana -https://www.imf.org/en/News/Articles/2023/05/24/tr051823-transcript-of-ghana-press-briefing